The recent pandemic is a meteor strike to the global economy, and potentially the global culture. The impact from this event will be felt for many years and could dramatically shift the way people live and shop. The distribution industry is experiencing simultaneously a collapse in demand and over-demand depending on which sector is serviced. Following are my observations of these changes and how best to position your business going forward.

1. Social Distancing Habits To Become the New Normal

The long-term psychological impact of the virus may end up being a far bigger societal impact than its near term lethality. Humans are fascinating creatures in that part of their makeup are their operating habits learned over time. They say to change to a new habit you need to follow the new routine for 30 days to rewire yourself for that habit. his lockdown and social distancing has been going on now for 9 weeks and could run another several weeks. The likely result is that interpersonal behaviors will change and it is possible that social distancing will become a new engrained habit.

The impact of this could substantially shift consumer habits away from retail shopping and towards e-commerce (more on this below) as well as change the way people work together.

2. Retail on Life Support

The U.S. has 4 times the retail square footage per capita than Europe (the next highest). That is a tremendous amount of overhead to support American spending habits. Prior to the COVID-19, we were already seeing record closures of retail locations. COVID-19 is accelerating that trend.

The lockdown of non-essential services is devastating the non-essential retail sector. Already we have seen Neiman Marcus file bankruptcy and I suspect an avalanche of retail bankruptcies will occur the next 6 months.

Retailers will need to rethink their business model, expand strongly into omni channel delivery and revamp their retail store experience into one that better engages their customers, and meets their customers needs. Digital transformation is non-optional. In the case of JCrew’s recent bankruptcy filing, NYTimes reported that they simply did not have the cash to invest in supply chain and digital transformation.

Consumers will still continue to buy the same or similar products once we emerge from this situation, but their method of shopping will shift more towards e-commerce.

3. The Acceleration of E-Commerce

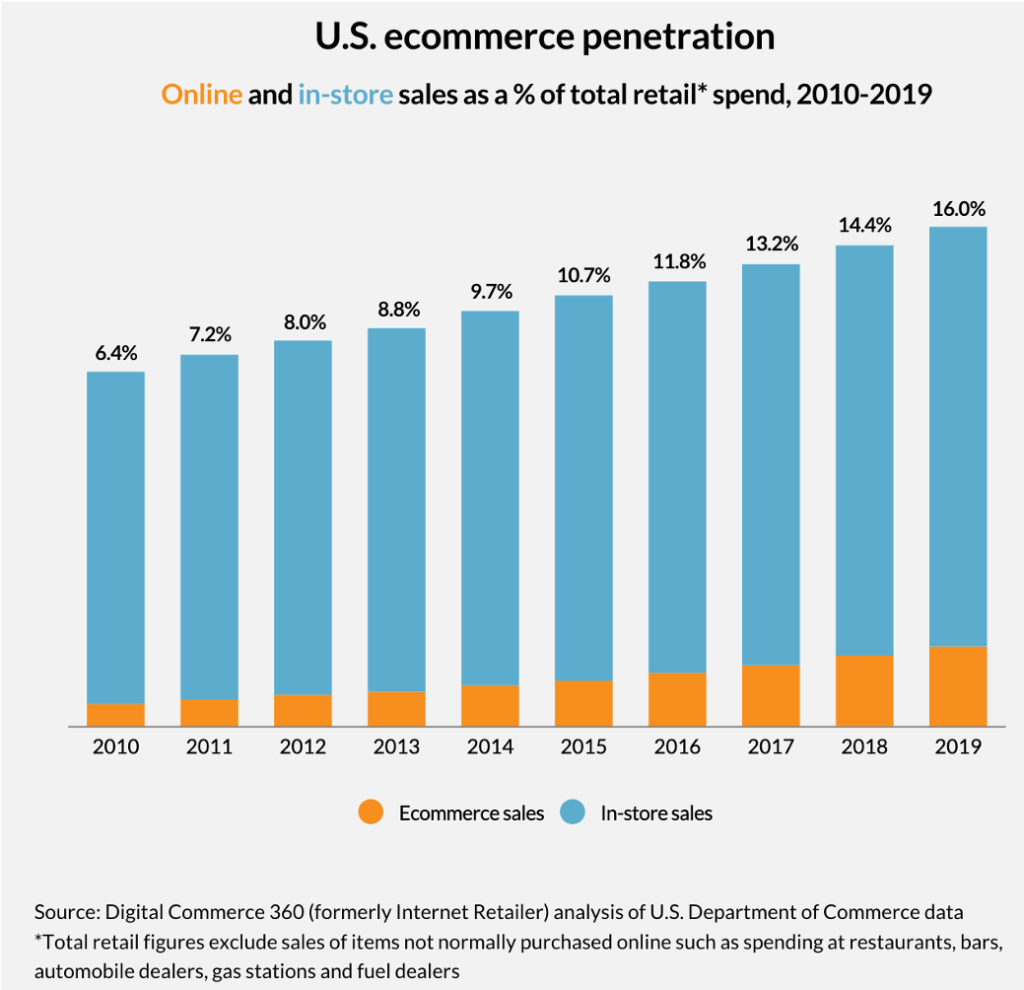

E-Commerce was about 16% of retail sales in 2019 and growing at 15% per year. Stay at home orders caused e-commerce to jump 49% in April alone.

B2B is much smaller, around 2-3%, but is growing at 40% a year. Much of the distribution network was caught on their heels with COVID-19 event. Those that are essential have seen their spike in product demand skyrocket beyond the normal seasonal peak in the fall. Amazon is adding over 100,000 new warehouse employees and Walmart is adding 50,000.

The big winner in this event are the e-commerce companies. Amazon’s stock just broke into new highs as have Shopify and other large e-tailers. Retail brands will need to beef up their e-commerce operations and learn how to operate them cost effectively.

E-Commerce is very labor intense. It requires much more labor per unit shipped than traditional bulk retail shipping. Retailers will need to invest substantially in their fulfillment operations to set them up to run e-commerce profitably. As Amazon has made clear, distribution is now a competitive advantage and not just a necessary expense.

Retailers will also have to rethink their distribution network. Traditional retailers have opted for large DC’s that service the whole country from one location. Amazon has successfully set customer expectations for 2 day delivery and with the shift towards more e-commerce, customers will continue to demand such on-time service.

In order for many retailers to be able to fulfill customer demands, they will need to regionalize their distribution centers into the 2 day delivery zones. This will require multiple smaller DC’s versus large, million+ square feet operations. This creates all sorts of operational challenges and cost visibility requirements across their network.

Selling to Amazon may also no longer be an option for some manufacturers and brands. Through a rigorous and data-rich operations finance practice, Amazon evaluates each product’s profitability. If a product is determined that it does not make money when taking into account delivery costs (2 day prime), then those products crash out of Amazon and the vendor is told they can sell though Amazon but they have to have it fulfilled elsewhere.

The above factors will force a major investment cycle in new distribution centers and new technologies that enable retailers to service their customers better. In the end, customers will benefits. The growing pains of digital transformation and de-centralized warehouse operations will require investment. Access to capital and a solid business case will be table stakes.

4. Record Unemployment and Labor Shortages Simultaneously

The irony of this event is that it is creating both record unemployment and major labor shortages at the same time! Certain industry verticals are getting devastated like: clothing retail, restaurants, and personal services whereas others are getting overwhelmed by demand, like grocery and medical supplies.

The labor shortage is caused by a couple factors. First is the giant jump in demand for medical and grocery items.

Historically Americans spent 50% of their food budget on “food away from home”, which is essentially restaurants and fast-food. COVID-19 is shifting things substantively to home meal preparation and consumption.

Medical products and devices demand is also skyrocketing. The demand outpaces the ability of manufacturers to produce them.

Secondly, certain government unemployment programs are guaranteeing employees wages regardless if they work so many are opting to stay at home and collect unemployment versus risk exposure at work. Third, social distancing requirements are impacting work flow and facility operations so they are not as efficient as before, thus requiring even more labor to get the same work done.

This will settle out over the next few months as labor shifts from heavily hit sectors towards sectors with high demand.

5. Reversal of Supply Chains

Prior to this event, we were already seeing political pressure to rethink US supply chains. Political pressure was applied to companies to move some of their manufacturing back to the United States. COVID-19 has really shown the weakness with current corporate offshoring strategies by making the US overly dependent on China and other offshoring destinations. When everything works as it is supposed to, this is a financially effective strategy, however if there are unforeseen disruptions it can create chaos.

COVID-19 is a large sledgehammer to offshore supply chains. Japan recently announced they will fund $2.2 billion to Japanese companies to move out of China. Europe and the United States are evaluating similar initiatives. A portion of this manufacturing will come back to the US but much will also shift to other areas like SE Asia, Latin America, Africa and India.

Manufacturing tends to higher wages to workers than warehousing and distribution centers, so this move will exacerbate the competition for labor in the US. As well, onshore manufacturers will need to evaluate their distribution strategy. With higher domestic labor costs, they will need to cost optimize distribution, especially e-commerce, to compete profitably.

Summary

With change comes opportunity. COVID-19 is a once in a lifetime event that will likely forever change the world. We will see major shifts in economic activity as consumers adopt to the new trends in motion. Companies that think ahead and invest wisely will profit from this shift, but many more will not make it.

The companies that survive and thrive will figure out how to run e-commerce profitably and invest in the correct tooling, tech stack that enable operational visibility and efficiency. They will build a culture of data driven decision making, and with shared accountability and goals so that they can meet customers on their terms.

Written by Dan Keto, President and CTO of Easy Metrics.