Utilize your own data to identify inefficiencies and manage your costs

The United States, and the world as a whole, is gearing up for a possible recession. For operations teams, this means continuing to deliver products and services at high velocity, but doing so with total control over and visibility into costs. The best teams will not just weather the storm – they will leverage the storm to innovate and turn it into a competitive advantage. Driving efficiencies with labor management software, operations financial management, and an accurate labor forecast are the essentials to navigate these turbulent waters.

Our company has helped operations teams survive two major economic events: the collapse of 1999-2001 caused by dot com mania, and the Great Recession of 2007-2011 caused by mortgage fraud. The magnitude and duration of the coming recession of 2022/2023 will be determined by several factors and how global and domestic leadership responds. As business leaders, the best we can do is to position our companies for these coming changes so we are not caught unprepared and plunged into financial duress.

The coming recession is the direct result of unprecedented fiscal and monetary debt, resembling the stagflation of the 70s, but with the potential to be much worse. This article will discuss the many competing forces impacting the economy, the potential outcomes, and then ways you can buttress your business for the coming storm. Some of the key economic factors to consider are:

- Inflation

- Interest rates

- The shortcomings of globalization

- Labor shortages

- The geopolitical situation

Inflation

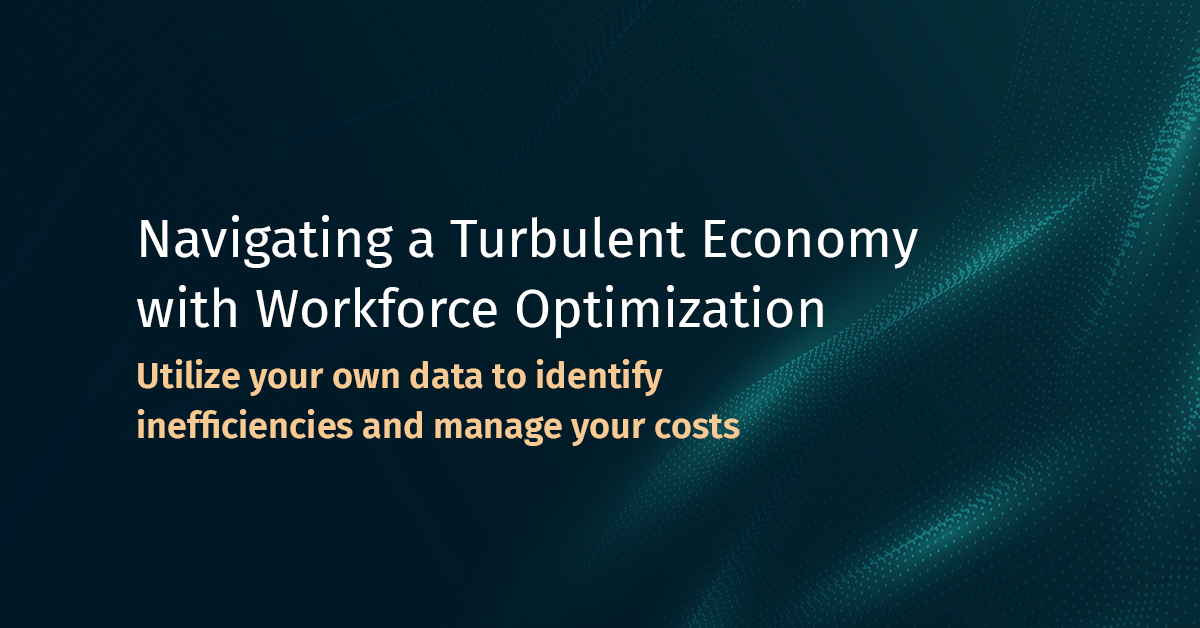

If grocery store prices are any indication, inflation is well underway. The Fed reported that Q1 inflation is 8.5%. But the U.S. government (conveniently) excludes energy and food from its CPI calculations. The true inflation figure is closer to 15%+ as calculated by John William’s ShadowStats using the 1980s algorithm, shown in Figure 1 here.

(Figure 1)

Since most government transfer payment programs are indexed to the official inflation rate, the government is incentivized to under-report the real inflation rate. The Federal Reserve created 65% of all money in existence between 2019 and 2021, pushed interest rates down to record lows, and the US Government flooded the system with stimulus to help deal with the economic damage caused by the pandemic. The excess liquidity, cheap money and stimulus quickly found its way into the housing and automobile markets, driving those asset prices to record high levels.

At the same time, COVID created large disruptions in the global supply chain and domestic production challenges with labor and safety compliance regulations. The US economy, prior to COVID, was a fine-tuned machine optimized to the “just in time” supply chain. As soon as COVID hit, that fine-tuned engine started to grind down and those supply disruptions, combined with fiscally generated excess demand, created the perfect storm for inflation.

Initially, Fed Chair Jerome Powell said that inflation was transitory. This opinion was based on the traditional view that inflation is a currency and fiscal phenomenon. The Federal Reserve has responded by increasing interest rates and the Federal Government has not renewed most COVID stimulus programs. However, inflation still is going strong due the ongoing supply chain disruptions.

Reconfiguring supply chains is a multi-year process and will require billions in investment to resolve. The Fed and US Government have taken steps to reduce the demand side of the equation, but the supply side is still very challenged and inflation may continue to pose tremendous challenges for the next few years. As such, it becomes even more important to maximize operational efficiency and have a realistic and accountable plan for labor — areas that are both controllable and directly impact costs.

Interest Rates

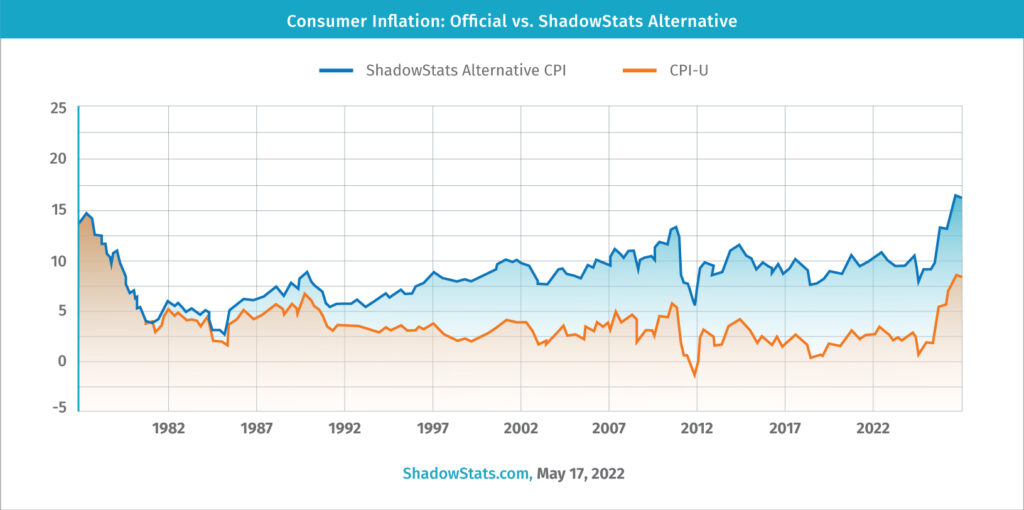

In February 2022, the US Federal Reserve fired a shot over the bow of the global economy and increased interest rates 25 basis points, and then by another 50 basis points in March. Interest rates still are near historically low levels, but the Feds guidance now recognizes inflation as non-transitory and thus they forecast several more tightening cycles until inflation is under control. The market has responded: 30 year Treasuries have dropped almost 20% in price and 30 year mortgages have gone from 2.75% in November 2021 to almost 5.5%.

(Figure 2)

This has increased the cost of capital for both consumer and business loans. For consumers, this will decrease their ability to borrow and afford large purchases. For business, this will shift business priorities – likely in the direction of cost containment and profitability vs. scale at any cost.

Prior to this change in interest rates, because of cheap money, many businesses were focused on growth at any cost. Company valuations were richly rewarded for top line growth regardless of the bottom line. As soon as the first interest rate increase hit, richly valued growth companies have seen their market caps plummet by as much as 80%, and likely have further to fall.

Company mentality has quickly pivoted away from top line growth at any cost, to more conservative growth models with a major focus on bottom line growth through cost reduction. Considering the labor shortage, improving labor management and adopting an operations financial management practice may be the most efficient path to those reductions.

Interest rates will also adversely impact capital expenditures. During COVID, due to labor cost increases and labor shortages, companies invested heavily in automation efforts to offset labor challenges. The increased cost of capital may impact automation investments. Companies will need to reevaluate investment priorities and look for other ways to reduce costs. Rather than rushing into automation, strong consideration should be given to “optimization” before “automation”. That is, the practice of understanding the labor cost of every activity, and driving out waste accordingly. By comparing the costs of a well-managed and already efficient workforce to the costs of a potential automation alternative, the ROI of large capital investments can be accurately predicted.

The Shortcomings of Globalization

The pandemic has shown us the risk of a highly globalized supply chain. Dependency on foreign manufacturing has created shortages across all parts of the economy and show few signs of letting up, and actually could get worse. It’s true that, when running efficiently, globalization can provide the highest quality product at the best price.

But when this system breaks down, production can grind to a halt.

As an example, at one point Ford had over 100,000 vehicles almost finished sitting in storage because they couldn’t get the microchips needed for them. An automobile has thousands of parts, but if there’s even one missing component, you can’t ship the vehicle.

Since the 1970’s, the US has shifted a substantial portion of its manufacturing base to lower cost countries. This shift initially started with low value, high relative labor consumer goods like clothes and shoes. As technological capabilities in those countries improved, more complex products like microchips, electronics and automobiles were produced.

Complex products require an economic ecosystem to build. For example, an iPhone may have hundreds of components that are assembled into the final product. Those subcomponents are outsourced to other companies. Building an iPhone may require the participation of 100 different companies, each producing a specific component type. To be cost effective, many of the suppliers for individual parts will be located in the same area, thus creating an iPhone ecosystem. If a portion of that ecosystem — say, the portion responsible for microchip production — falls behind or collapses, the rest grinds to a halt.

This challenge is being seen now by every industry. Almost every product, whether bulk commodity or highly complex product, is suffering from shortages, price increases and/or unavailability. And as geopolitical tensions continue, the cracks in the veneer of globalization will become even more apparent.

In response, companies are starting to reshore many of their operations. However, these efforts require tremendous investment and are hindered by a labor shortage in the United States. Products that require a full ecosystem to build, like computers and electronics, are much more difficult to onshore. This is reflected in the rising costs of these goods.

Reshoring these ecosystems will be most effective if operations have 100% visibility into the cost and performance of their workforce and processes. Setting targets and KPIs, and managing the business for efficiencies will enable U.S. based operations to compete with foreign counterparts. Being able to accurately predict the costs of manufacturing and fulfilling orders onshore is a business critical priority. Adopting the right technology and automating labor management for operations is required for this effort.

Labor Shortages

The US and Global labor markets are experiencing an unprecedented labor shortage across all aspects of the economy. From rice farms in Vietnam to management positions in corporate America, companies are struggling to find and retain talent. The supply chain industry seems to be particularly impacted by this shortage. Many of the companies we talk with are consistently 5-10% understaffed — which then feeds into the reduced supply chain capacity and product delays.

We presented at a supply chain software conference in the fall of 2021 and queried the audience on these issues. The first question was, “Are you having difficulty staffing your organization?” and the response was nearly unanimous in the affirmative. The second question was, “Is your current unit volume higher or lower than before the pandemic?”. The majority of the audience responded with lower. Lower volume generally equates to lower labor needs but all of these companies are in need of people and it cuts across all industries.

It is estimated that 5 million people have left the US labor force since the beginning of the pandemic. There are a multitude of reasons speculated, but the bottom line is there is much more work than people to do the work. With the continued retirement of the aging Baby Boomer demographic, this labor shortage will likely continue unless there is large decline in the domestic and global economies. Companies will need to do more with less which will require driving operational efficiency into their organization.

Geopolitical Situation

The recent invasion of Ukraine by Russia has exposed the downsides of the global supply chain and its interdependence among all countries. Ukraine is a large producer of wheat, fertilizer, and other commodity staples. The invasion has impacted exports/production and resulted in a substantial increase in food and energy prices. This has impacted the cost of living in western countries, but has the potential to create famine in underdeveloped nations that are dependent on those commodities.

On the horizon, there are tensions brewing between Taiwan and China that might escalate. The impact of a formal conflict would severely impact the electronics supply chain because Taiwan is a large producer of critical semiconductors used in automobiles, computers, and more. We live in a digital world and Taiwan is a vital supplier. If China were to invade Taiwan, it would likely plunge the world into a global recession.

Keeping an eye on the both domestic and global political upheaval is important. How will it affect the labor supply? Will your product mix change? Will shipping be disrupted, and if so, what alternative options exist? Having a plan in place can help mitigate the potential damages. A good plan needs good data — we can help with that.

Optimize your Workforce

The bottom line is in the last six months the world and business climate have shifted dramatically. The world is now in a “risk off” investment climate. Companies are quickly pivoting away from growth of the top line and toward reducing costs and growing or maintaining the bottom line. In the tech sector, there are already large hiring freezes and layoffs across the sector in order to shift their cost structure.

Companies in other sectors will need to make similar adjustments. Cost inputs look to continue to increase, labor shortages will persist due to the large imbalance, and the consumer will continue to be financially strained.

In order to protect your company from these cross currents, companies will need to invest in workforce optimization. They will need to drive operational excellence and focus intently on cost optimization of their entire cost structure.

In trucking and distribution, labor is one of the highest cost inputs, but it is also the most variable on a unit cost basis. Easy Metrics OpsFM (Operations Financial Management) platform gives companies visibility into all unit costs by process, employee, customer, and product type. Easy Metrics unifies your work flow data, to include all disparate data sources, across your entire operational network. OpsFM shows you the what and the why within your cost structure, and quantifies the financial ROI available to you in process optimization and automation.

As a capital efficient company, Easy Metrics is well positioned to weather the coming economic storm while we assist our customers to optimize their cost structure and thrive.