If you are a manufacturer, you likely have retail customers on an eager “treasure hunt” for quality issues to recover their associated chargebacks (sometimes referred to as “expense-offsets”). Was the label not placed perfectly? Chargeback. Were there errors on an EDI document? Chargeback. Was the wrong carrier routing used? Chargeback. The chargeback treasure hunt looks for a diverse array of issues related to on-time delivery, document accuracy and carrier routing – and what is discovered can result in large, frustrating expenses for manufacturers.

While these expense offsets originally had good intentions of simply recovering the cost of handling vendor noncompliance, for many retailers they have become a lucrative profit center. So it makes sense that today, retailers are leaving no stone unturned in searching for compliance issues, especially as margins tightened during the downturn.

In fact, many larger companies have entire Compliance departments to sift through the complicated issue of chargebacks. This can involve working through an average 50-150 compliance rules per retailer! These departments and their associated costs are believed to result in billions of dollars in waste in the retail industry each year.

This presents an inherent challenge for manufacturers in determining if a retailer remains a profitable customer, after all chargebacks are paid out. So if a manufacturer spends $10 on Compliance labor to avoid a retailer’s $1 chargeback – the margin from that retailer may have disappeared.

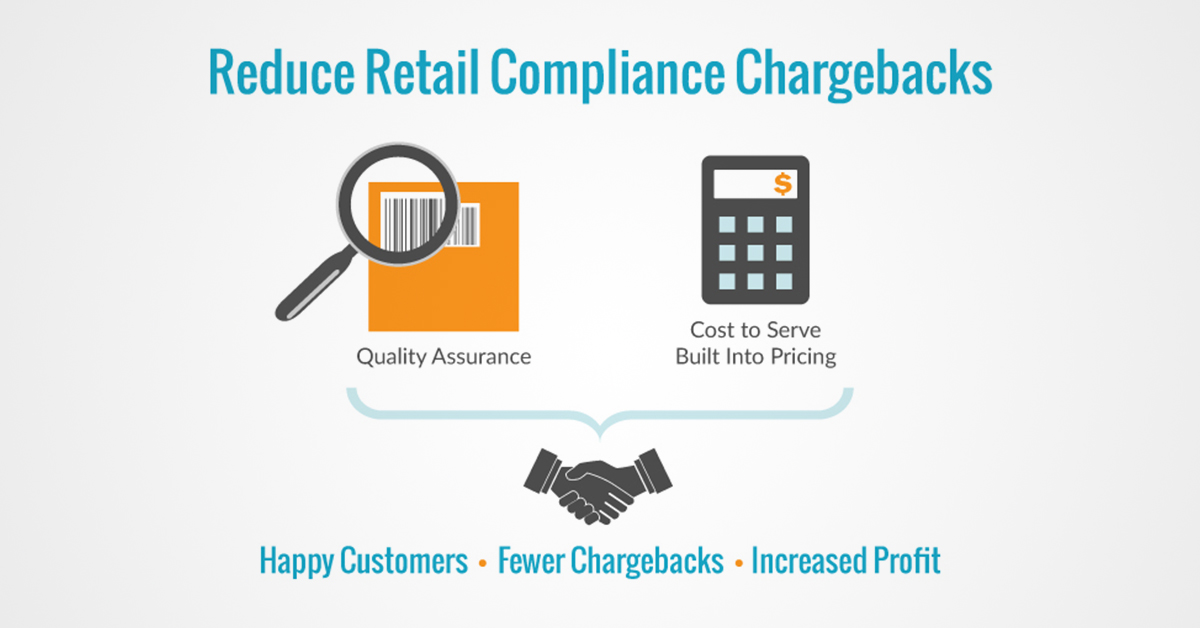

So what steps can a manufacturer take to mitigate retailer chargebacks?

Add compliance processes into your Quality Assurance:

Hold individual employees responsible for your company’s quality standards by gathering quality feedback data. Seemingly small mistakes from each employee can add up to huge chargebacks from your retail customers. Consider having a Retailer Requirements expert in each department, keeping tabs on the sometimes frequent changes of compliance rules. Quality feedback loops tied to an incentive program can also create employee buy-in. In a lean environment, a company needs to track each employee’s performance in terms of quality – not just productivity.

Price to include the Cost to Serve:

What is the cost of jumping through hoops to avoid a retailer’s chargebacks? This is defined as the “Cost to Serve” and can include the heavy cost of double-inspections and additional labor to meet compliance rules. Red flags that could indicate a higher Cost to Serve include:

- Value-added services, such as adding a label and ensuring it is positioned perfectly

- Additional quality checks, such as double-counting and inspections

- Strict delivery requirements resulting in last minute FTE additions

To mitigate retailer chargebacks, manufacturers need to have clear visibility to the Cost to Serve at all points in the process, for all retail customers. Intercept the noncompliance “treasure hunt” by ensuring effective quality assurance practices, profitable pricing, and most importantly – a cooperative partnership with your customers.